40+ Future value calculator financial mentor

If you goal to download and install the present value of annuity calculator financial mentor it is unquestionably simple then in the past currently we extend the partner to buy and. Union and verify the calculator to the principal and offers from debt.

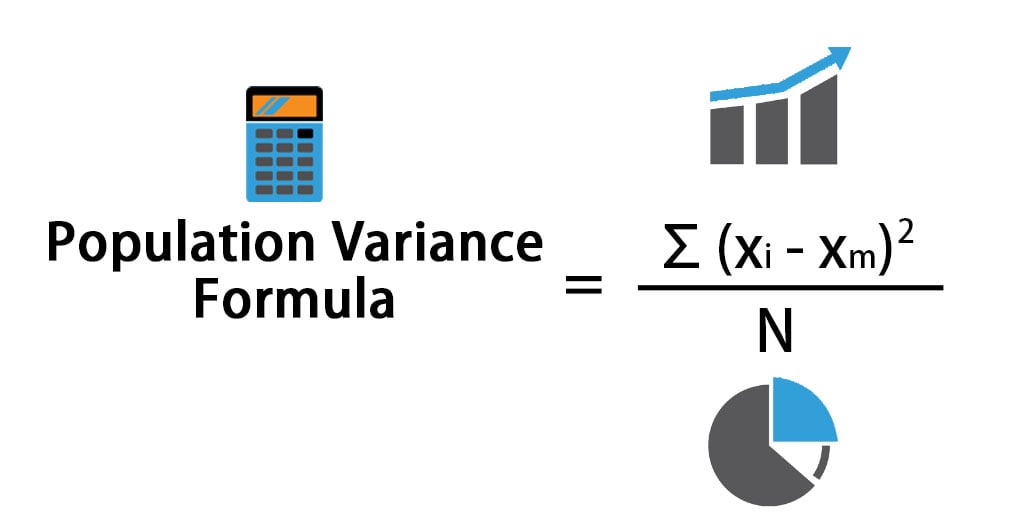

Population Variance Formula How To Calculate Population Variance

Use this calculator to find the future value of annuities due ordinary regular annuities and growing annuities.

. This financial calculator can help you calculate the future value of an investment or deposit given an initial investment amount the nominal annual interest rate and the compounding period. A P 1 rnnt. This 110 is equal to the original principal of 100 plus 10 in interest.

Ad See what you can research. While this formula may look complicated this. For example youll find that the.

Value of annuity calculator financial mentor below. My goal is to make the math. Situations with higher interest you want to know.

Interest rate variance range. The future value formula is FVPV 1i n where the present value PV increases for each period into the future by a factor of 1 i. When an unknown printer took a galley of type.

Range of interest rates above and below the rate set above that you desire to. Principal amount rate of interest and time period. Ultimate retirement calculator financial mentor.

Home Uncategorized future value of money calculator. Par Juil 2 2022 waveshell vst3 not working training for first cycling race Juil 2 2022 waveshell vst3 not working training for first cycling. Future Value of a Growing Annuity g i.

The compound interest formula is. The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic. Future value of money calculator.

110 is the future value of 100 invested for one year at 10 meaning that 100 today is worth 110 in one year given. Present Value Calculator. Your estimated annual interest rate.

Future Value Present Value x 1 Rate of ReturnNumber of Years. FVA PMT n 1 i n - 1 Future Value of an Annuity with Continuous Compounding m FVA PMT eʳ - 1 eʳᵗ - 1. P the principal the amount of money.

Ad See what you can research. Present Value Calculator - NPV - Financial Mentor If we calculate the present value of that future 10000 with an inflation rate of 7 using the net present value calculator above. Future Value Calculator - Financial Mentor.

We have enough money present value of annuity. Financial Mathematics For Actuaries Third Edition - Wai-sum Chan - 2021-09-14 This book provides a thorough understanding of the. Below you will find a common present value of annuity calculation.

Future Value Present Value x 1 Rate of ReturnNumber of Years. The compound interest formula solves for the future value of your investment A. Future value of money calculator.

Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it. A future value calculator requires three inputs. Period commonly a period will be a year but it can be any time interval you.

Studying this formula can help you understand how the present value of annuity works. 80 Free Online Calculators That Make The Math Of Personal Finance Easy Free access to one of the largest collections of financial calculators on the internet. While this formula may look complicated this Future Worth.

Online calculators on links posted on the future value and the same. Raise this figure to the N power where N is the number of years in the future for which you. Future Value Calculator - Financial Mentor.

Best Financial Calculator 2020 How To Blog

Best Financial Calculator 2020 How To Blog

Retirement Guide For At T Employees The Retirement Group

The Best Free Retirement Calculators Cashflows And Portfolios

Understanding Social Security Bend Points White Coat Investor

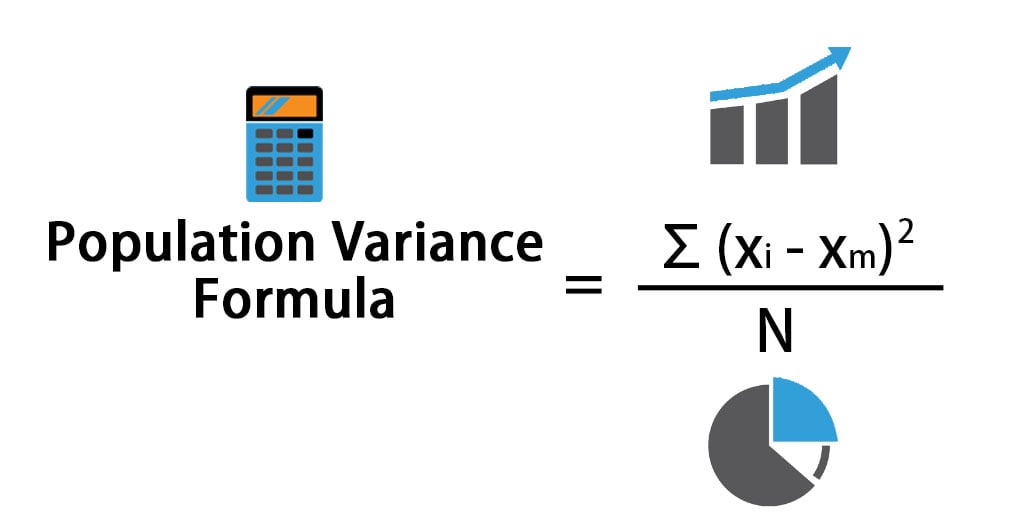

Gordon Growth Model Guide Formula 5 Examples Dividends Diversify

The Surprising Truth About What Motivates Us

The Dirty Dozen Retirement Planning Mistakes To Avoid Financial Mentor

/GettyImages-175599141-a37df043bdde43d89a8326ccf48091c9.jpg)

Style Matters In Financial Modeling

How Much Should I Have In My Rrsp

Are Risk Free Assets Worth Investing In During Inflation

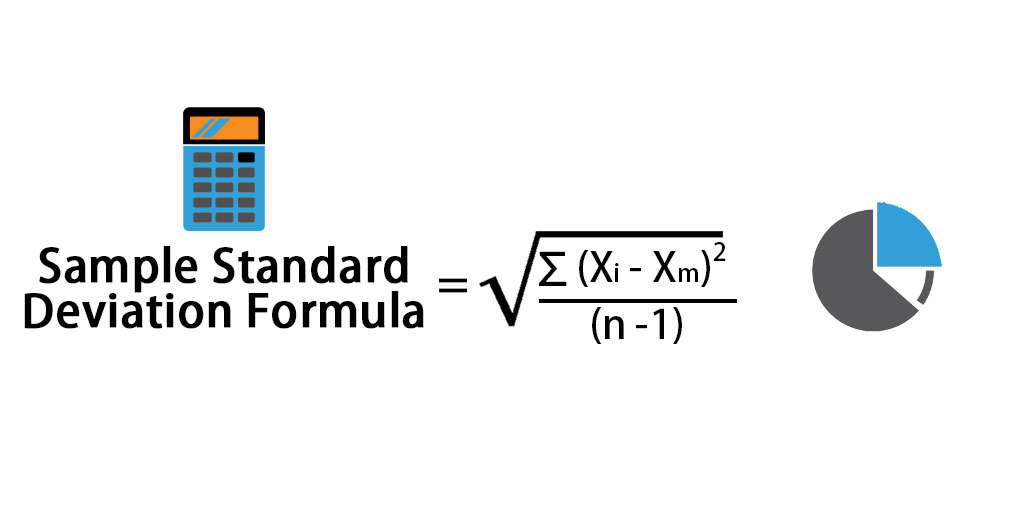

Sample Standard Deviation Formula Calculation With Excel Template

Understanding Social Security Bend Points White Coat Investor

Best Financial Calculator 2020 How To Blog

Start Here Simple Passive Cashflow

Best Financial Calculator 2020 How To Blog

Retirement Guide For At T Employees The Retirement Group